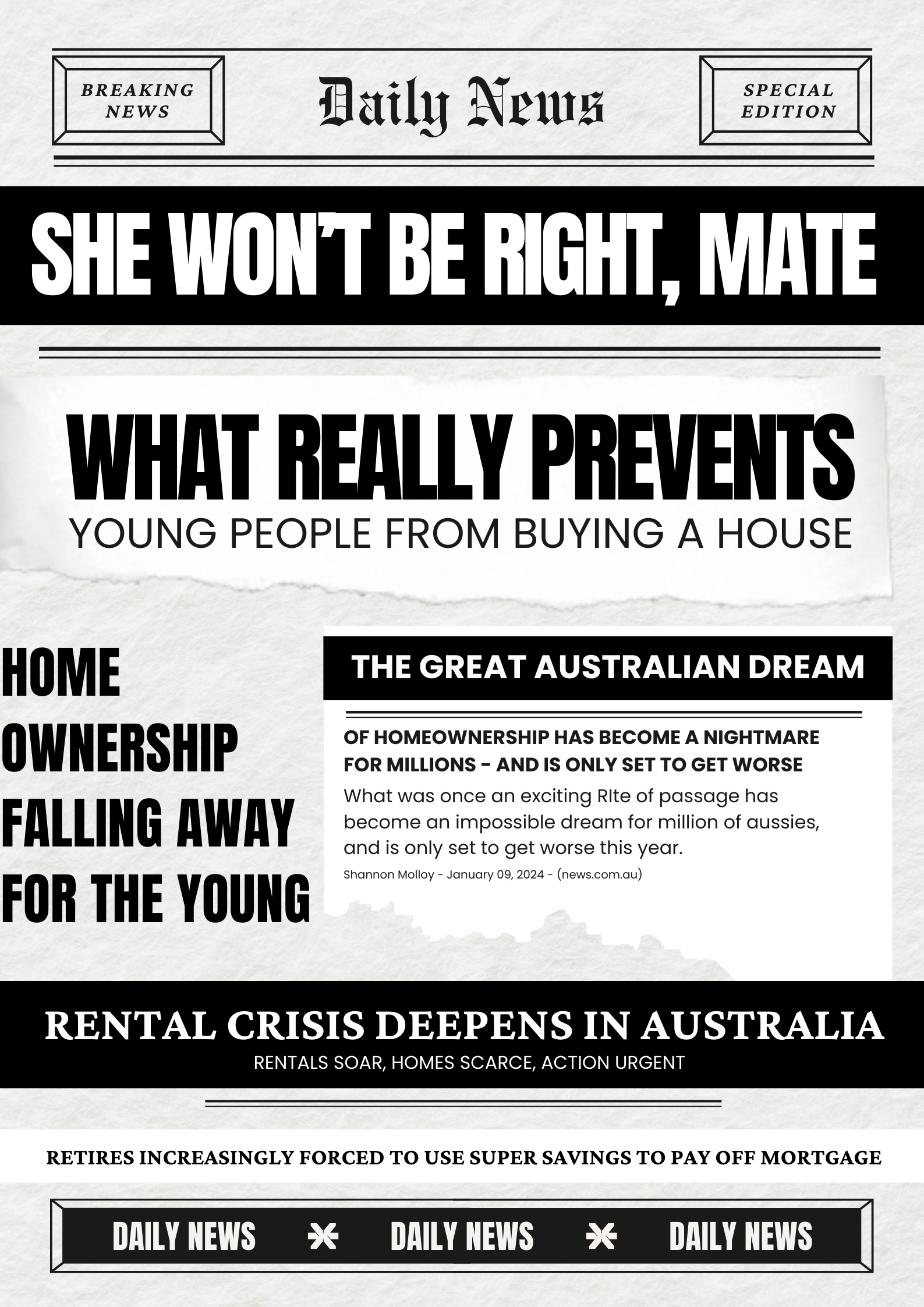

HOWEVER, THE BIGGEST HIT IS THE

COST OF HOUSING.

SAVING FOR DEPOSIT IS NOW TAKING 17 YEARS

BY THE TIME YOU HAVE SAVED UP THE PRICES HAVE JUMPED SO IT IS ALMOST IMPOSSIBLE TO GET INTO THE HOUSING MARKET UNLESS YOU GET HELP FROM WHAT IS NOW COLLOQUIALLY KNOWN AS MUM AND DAD BANK.

HERE IS THE LATEST NEWS ON DEPOSIT.

Plan Management

Bookkeeping and General Accounting Support

Business Advisory

How We Do It:

At PlanSmart Solutions, we take pride in simplifying the complexities of NDIS plan management. Here's how we do it:

Swift Invoice Processing: We leverage state-of-the-art technology to process invoices within a mere 2 days of receiving them. This means that our clients can expect their payments to be disbursed by the 4th or 5th day after submission. Our goal is to expedite your financial transactions for your convenience...

Unmatched Service Excellence: Our team is driven by a genuine passion for what we do. When you choose PlanSmart Solutions, you're selecting a partner dedicated to your success. We go above and beyond to meet your needs and ensure your NDIS funds are managed with the utmost care and precision.

Referral-Friendly: We value your trust and support. If you know of other NDIS participants who require NDIS plan management services, please don't hesitate to refer them to us. Rest assured that every referral will receive the same high level of commitment and support.

In essence, PlanSmart Solutions is your trusted partner for efficient NDIS plan management. We handle the financial intricacies, so you can focus on achieving your NDIS goals and living life to the fullest. Choose us for a reliable, efficient, and supportive approach to managing your NDIS funds.

Our comprehensive Bookkeeping and General Accounting Support services are designed to lighten your financial burden and allow you to focus on what you do best – running and growing your business. Here's how we can be the backbone of your financial success:

Accurate Bookkeeping:We ensure that your financial transactions are meticulously recorded, categorized, and up-to-date. With our expert bookkeepers at your service, you can trust that your financial data is both accurate and compliant with relevant regulations.

Financial Reporting: Timely and insightful financial reporting is essential for informed decision-making. Our team provides you with detailed financial statements and reports, giving you a clear picture of your business's financial health.

Expense Management: Keeping a close eye on expenses is crucial for maintaining profitability. We help you identify cost-saving opportunities and implement strategies to maximize your bottom line.

Tax Compliance: Navigating the complex world of tax regulations can be daunting. We ensure that your business remains in compliance with tax laws, minimizing your tax liability and reducing the risk of penalties.

Payroll Services: Managing payroll can be a time-consuming task. We offer efficient payroll solutions, including payroll processing, tax withholdings, and compliance, so you can pay your employees accurately and on time.

At PlanSmart Solutions, we understand that every business is unique. Our tailored accounting bookkeeping service and General Accounting Support services are designed to fit your specific needs, ensuring that your financial operations run smoothly and efficiently. With us as your financial partner, you can have confidence in the financial stability and growth of your business. Contact us today to take the first step towards financial success and peace of mind.

Our mission is simple: to empower individuals and businesses to not only create successful ventures but to sustain and thrive in an ever-evolving market landscape. Here's how we're here to support you:

Business Creation: We provide expert guidance and step-by-step assistance in turning your business ideas into reality. From initial planning to entity formation, we'll help you lay a strong foundation for your venture

Business Support: Starting and running a business comes with numerous challenges. Our team of experienced advisors is here to offer ongoing support and guidance, ensuring you have the resources and knowledge needed to overcome obstacles and achieve your goals.

NDIS Consulting: If your business is in the disability sector, we specialize in Disability consulting services to help you navigate the intricacies of this critical program. Our expertise will enable you to effectively provide essential services to individuals with disabilities.

Process Optimization: We believe that efficiency is the cornerstone of a successful business. Our team will work closely with you to assess your processes and identify areas for improvement, ensuring that your operations are as efficient and cost-effective as possible.

At PlanSmart Solutions, we are committed to your success. With our expertise and dedication, we'll help you not only navigate the complexities of business ownership but also thrive in your chosen industry. Your journey to a smarter, more prosperous business begins with us. Contact us today to take the first step towards a brighter business future.

The Great Australian Dream of homeownership has become

a nightmare for millions - and is only set to get worse

The so-called ‘Great Australian Dream’ of owning your own home has become a nightmare for millions of people – and is only set to get worse this year.

In previous generations, buying a pile of bricks was an achievement typically achieved in one’s late 20s to mid-30s, coinciding with starting a family and rising the ranks at work.

But these days, someone within that demographic is much more likely to be renting, forking out up to half their salary on a lease, while also grappling with flat wages growth and a cost-of-living crisis.

In just three decades, home ownership rates for those aged between 30 and 34 has collapsed from 65 per cent to just 45 per cent, Professor Stephen Whelan from the School of Economics at the University of Sydney said.

“This fall in ownership rate has happened as house prices have nearly tripled, indicating that increasing house prices and falling affordability are associated with a delay in housing market entry for Australian households,” Mr Whelan said.

Unmatched Service Excellence: Our team is driven by a genuine passion for what we do. When you choose PlanSmart Solutions, you’re selecting a partner dedicated to your success. We go above and beyond to meet your needs and ensure your NDIS funds are managed with the utmost care and precision.

Referral-Friendly: We value your trust and support. If you know of other NDIS participants who require NDIS plan management services, please don’t hesitate to refer them to us. Rest assured that every referral will receive the same high level of commitment and support.

In essence, PlanSmart Solutions is your trusted partner for efficient NDIS plan management. We handle the financial intricacies, so you can focus on achieving your NDIS goals and living life to the fullest. Choose us for a reliable, efficient, and supportive approach to managing your NDIS funds.

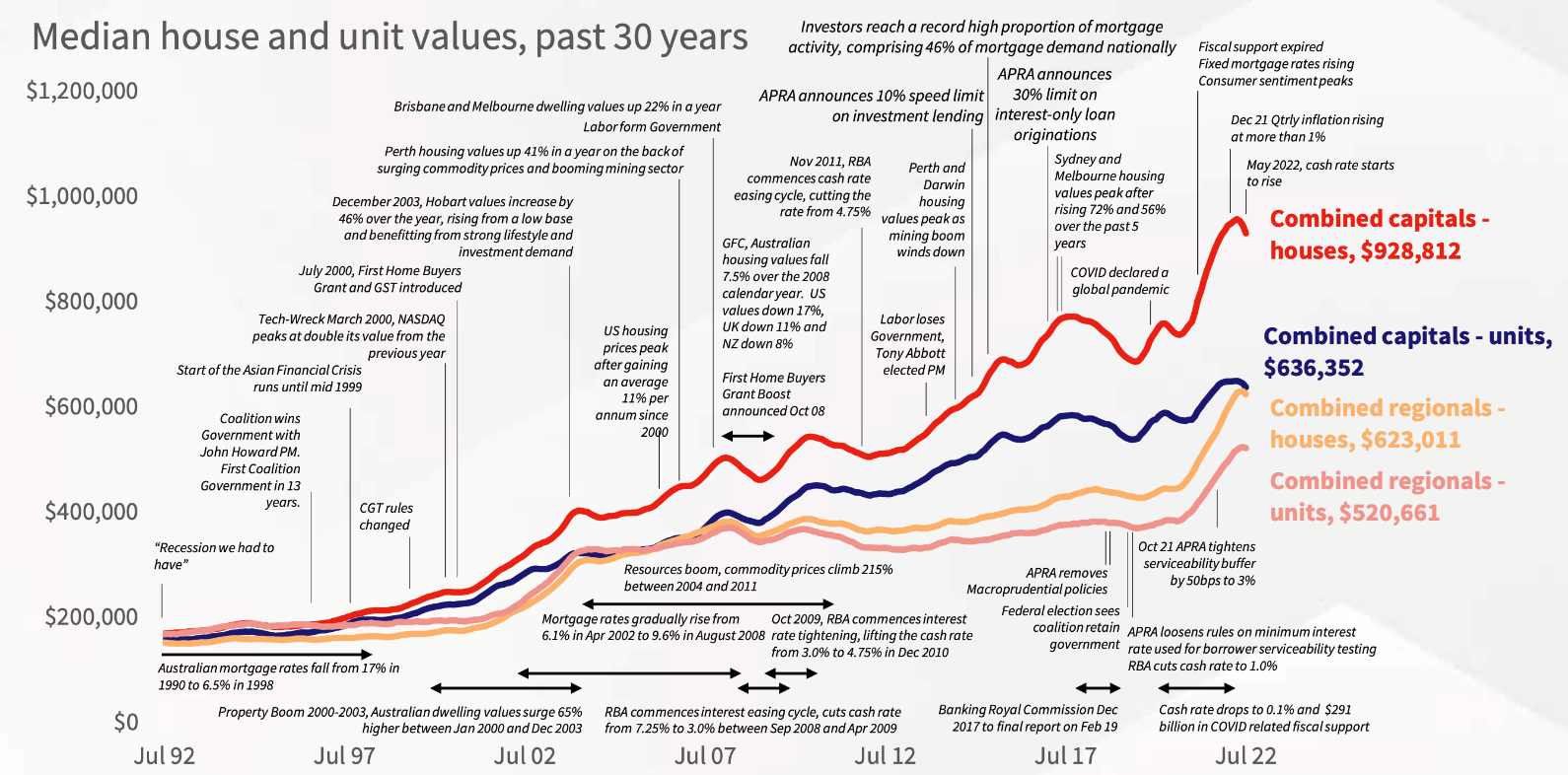

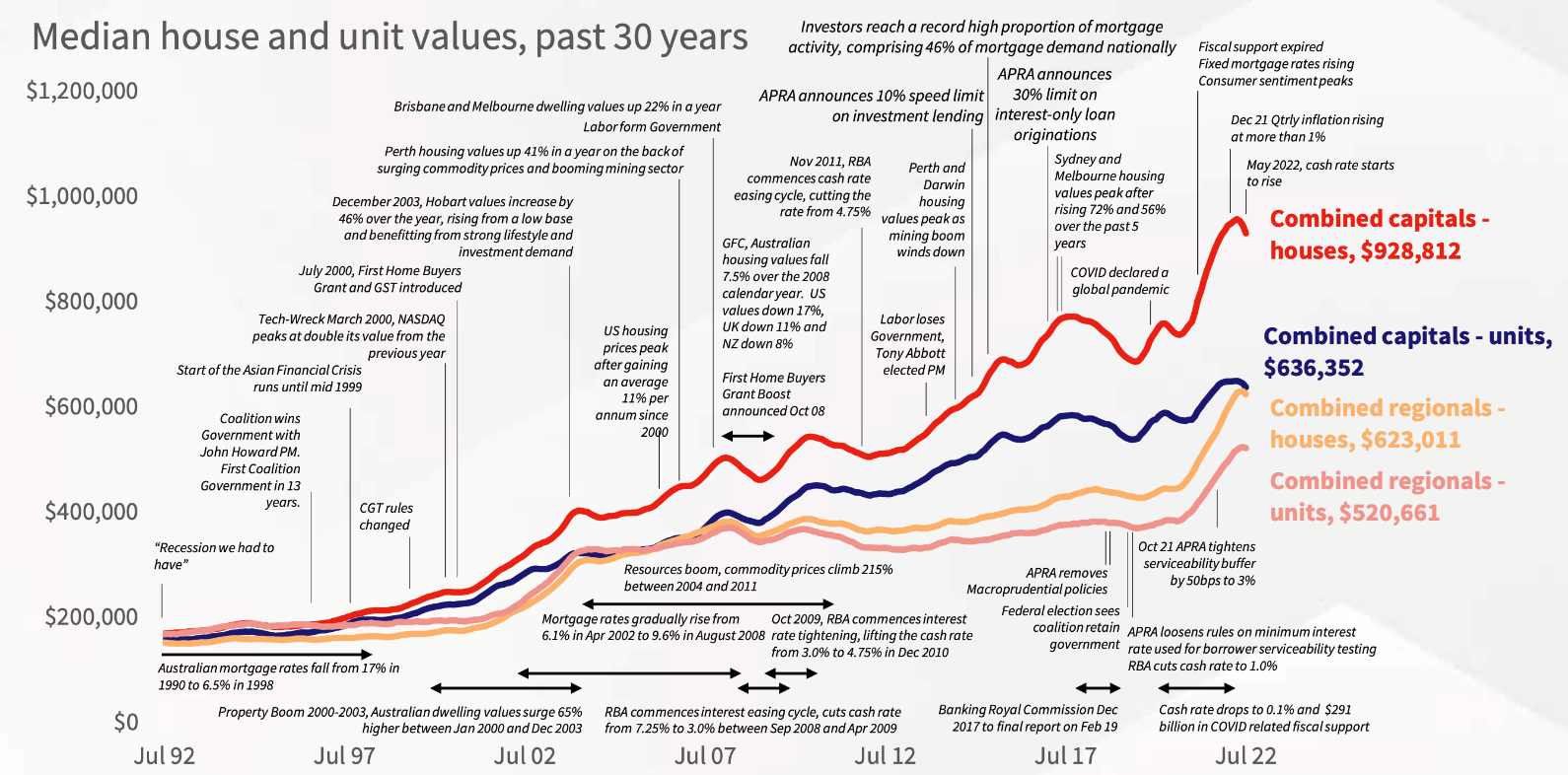

Australian Property Prices Continues to Rise

Over the past 30 years, we have observed various cycles of growth and declines across the national index. Each of these upswings and downturns have been influenced by various factors such as taxation policy, monetary policy decisions, economic shocks, fiscal stimulus, and broader economic conditions.

A primary factor behind the increase in property prices is the demand for housing outstripping its supply. If we don’t take appropriate steps to address the housing shortage, the demand for housing will likely continue to rise, putting pressure on property prices to rise even further. To put this in perspective, Australia is predicted to experience above-average population growth. Historical trends show that with a growing population, there is a natural increase in property prices due to higher demand.

Business Support: Starting and running a business comes with numerous challenges. Our team of experienced advisors is here to offer ongoing support and guidance, ensuring you have the resources and knowledge needed to overcome obstacles and achieve your goals.

NDIS Consulting: If your business is in the disability sector, we specialize in Disability consulting services to help you navigate the intricacies of this critical program. Our expertise will enable you to effectively provide essential services to individuals with disabilities.

Process Optimization: We believe that efficiency is the cornerstone of a successful business. Our team will work closely with you to assess your processes and identify areas for improvement, ensuring that your operations are as efficient and cost-effective as possible.

At PlanSmart Solutions, we are committed to your success. With our expertise and dedication, we’ll help you not only navigate the complexities of business ownership but also thrive in your chosen industry. Your journey to a smarter, more prosperous business begins with us. Contact us today to take the first step towards a brighter business future.

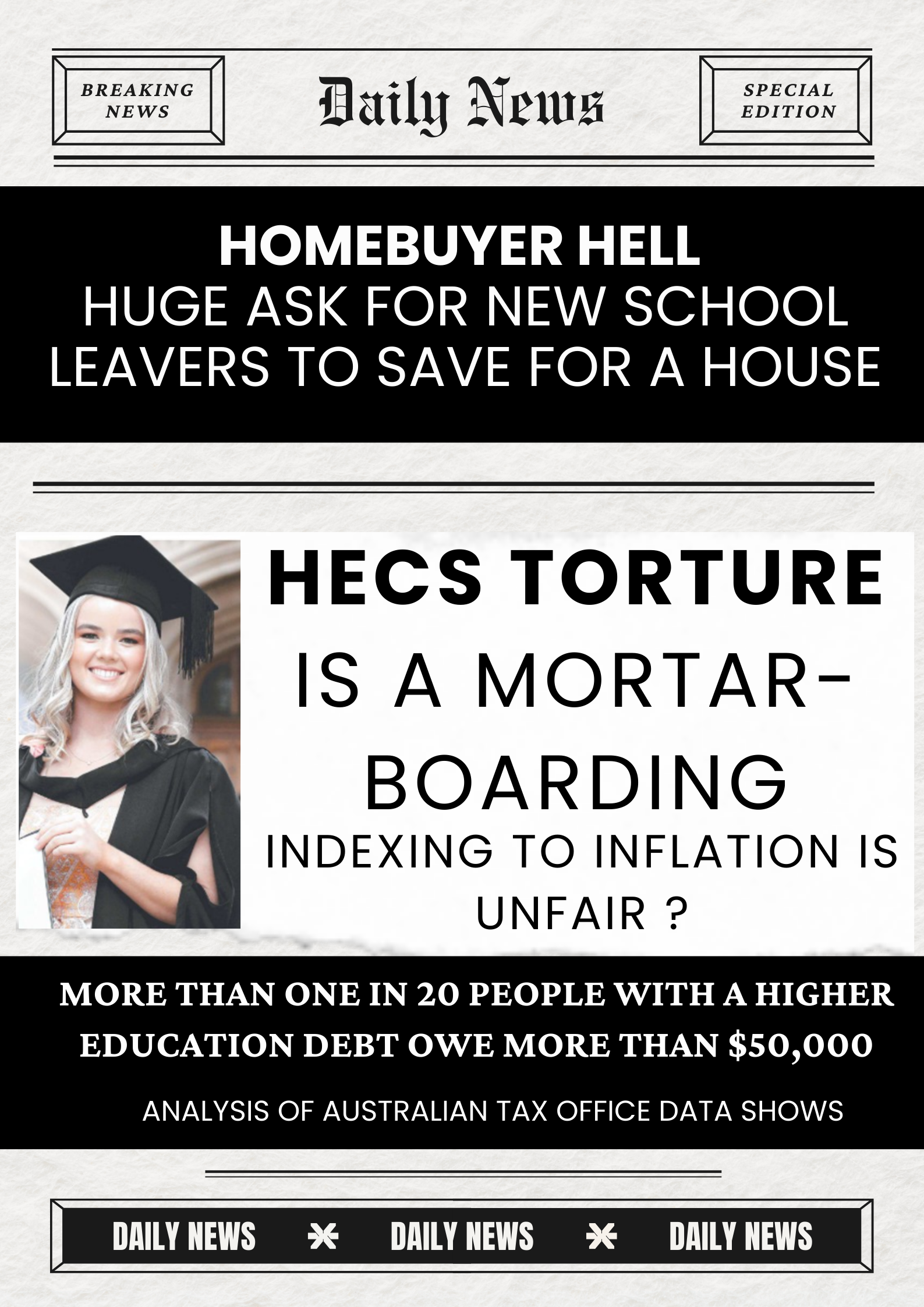

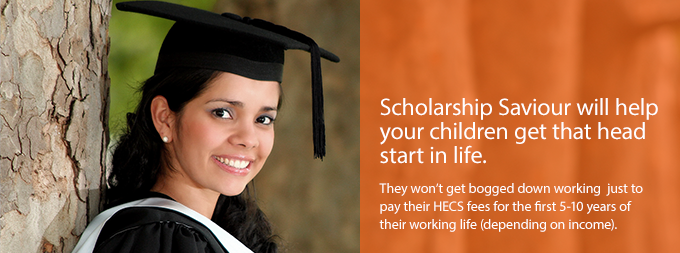

'Not good for australia': education costs

rising

faster than most households bills

The price of education has skyrocketed in Australia, as the basic costs to send a child to school, university or kindergarten climb quicker than almost every major household expense monitored by the Australian Bureau of Statistics.

As rapid inflation and interest rate rises add to living costs, analysis of the consumer price index shows education fees have escalated in the past 20 years to fill three of the top 10 fastest-growing expenses among 87 categories tracked by the ABS.

Superannuation: Retirees increasingly forced

to use super savings to pay off mortgage

Retirees are increasingly having to use their superannuation to pay off mortgages as housing costs and home loans expand in size.

The decline in home ownership rates among older Australians is posing a significant threat to the adequacy of Australia’s retirement income system, according to a new report commissioned by the Australian Institute of Superannuation Trustees (AIST).

Independent economist Saul Eslake – who is the author of the report titled, “No place like home: the impact of declining home ownership on retirement” – said the decline in home ownership among younger Australians can also be seen among the 35 to 55 age bracket.

“They will increasingly use their super to pay off their mortgage debt which means they won’t be using their super to fund their retirement incomes and instead will be relying on the pension.”

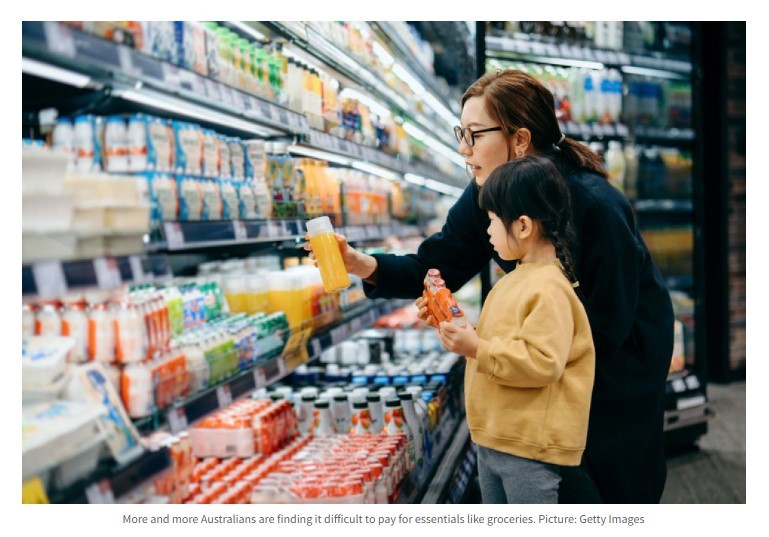

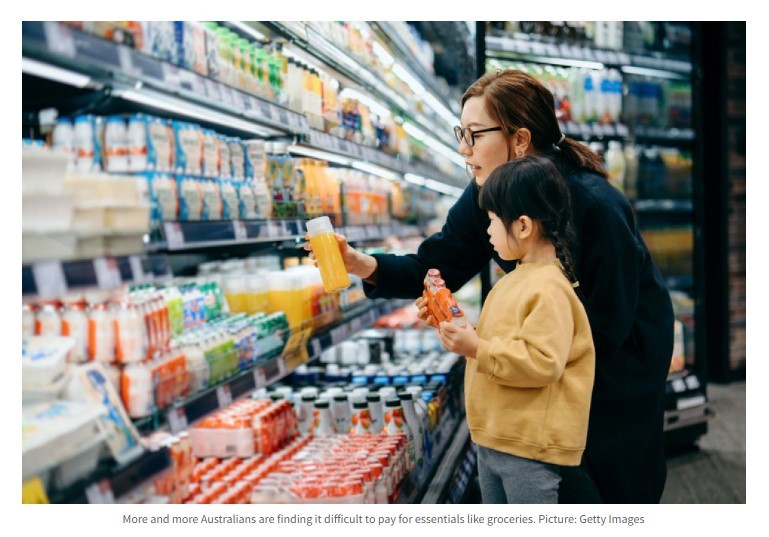

Most australians are struggling with food,

energy, health and housing costs

Many Australians are facing a long-term cost-of-living crisis.

Thanks to inflation and incremental interest rate rises, more than half are reportedly only just making ends meet – or actually failing to do so.

It’s also getting harder and harder for many of us to pay for essentials like food, bills, rents and mortgages. This level of financial stress is similar to what was reported during the pandemic – with 57 per cent of people struggling in 2020 and 55 per cent in 2021.

So, which groups of Australians are now finding it almost impossible to pay for necessities? And how can we encourage greater financial security?

Business Support: Starting and running a business comes with numerous challenges. Our team of experienced advisors is here to offer ongoing support and guidance, ensuring you have the resources and knowledge needed to overcome obstacles and achieve your goals.

NDIS Consulting: If your business is in the disability sector, we specialize in Disability consulting services to help you navigate the intricacies of this critical program. Our expertise will enable you to effectively provide essential services to individuals with disabilities.

Process Optimization: We believe that efficiency is the cornerstone of a successful business. Our team will work closely with you to assess your processes and identify areas for improvement, ensuring that your operations are as efficient and cost-effective as possible.

At PlanSmart Solutions, we are committed to your success. With our expertise and dedication, we’ll help you not only navigate the complexities of business ownership but also thrive in your chosen industry. Your journey to a smarter, more prosperous business begins with us. Contact us today to take the first step towards a brighter business future.

Horror warning as rent rises tipped to hit

insane highs up until 2026

The grim news continues for the one-in-three Australians who rents a home after new analysis revealed that rents will jump a staggering 10 per cent more this year – the highest level since the GFC – and will continue to rise by extraordinary levels into 2026.

Analysis from investment group Jarden shows how the cost of living crisis will continue to hit the one third of Australians who rent, with rental price growth expected to soar beyond its current 15-year high of 7.8 per cent.

It has examined rental inflation in Australia and found it is already running at 10 per cent higher this year – a figure not seen since the GFC in 2008 – and will jump by 8 per cent in 2025. Rents are expected to continue to rise above 6 per cent into 2026 too.

Business Support: Starting and running a business comes with numerous challenges. Our team of experienced advisors is here to offer ongoing support and guidance, ensuring you have the resources and knowledge needed to overcome obstacles and achieve your goals.

NDIS Consulting: If your business is in the disability sector, we specialize in Disability consulting services to help you navigate the intricacies of this critical program. Our expertise will enable you to effectively provide essential services to individuals with disabilities.

Process Optimization: We believe that efficiency is the cornerstone of a successful business. Our team will work closely with you to assess your processes and identify areas for improvement, ensuring that your operations are as efficient and cost-effective as possible.

At PlanSmart Solutions, we are committed to your success. With our expertise and dedication, we’ll help you not only navigate the complexities of business ownership but also thrive in your chosen industry. Your journey to a smarter, more prosperous business begins with us. Contact us today to take the first step towards a brighter business future.

The Great Australian Dream of homeownership has become

a nightmare for millions - and is only set to get worse

The so-called ‘Great Australian Dream’ of owning your own home has become a nightmare for millions of people – and is only set to get worse this year.

In previous generations, buying a pile of bricks was an achievement typically achieved in one’s late 20s to mid-30s, coinciding with starting a family and rising the ranks at work.

But these days, someone within that demographic is much more likely to be renting, forking out up to half their salary on a lease, while also grappling with flat wages growth and a cost-of-living crisis.

In just three decades, home ownership rates for those aged between 30 and 34 has collapsed from 65 per cent to just 45 per cent, Professor Stephen Whelan from the School of Economics at the University of Sydney said.

“This fall in ownership rate has happened as house prices have nearly tripled, indicating that increasing house prices and falling affordability are associated with a delay in housing market entry for Australian households,” Mr Whelan said.

Unmatched Service Excellence: Our team is driven by a genuine passion for what we do. When you choose PlanSmart Solutions, you’re selecting a partner dedicated to your success. We go above and beyond to meet your needs and ensure your NDIS funds are managed with the utmost care and precision.

Referral-Friendly: We value your trust and support. If you know of other NDIS participants who require NDIS plan management services, please don’t hesitate to refer them to us. Rest assured that every referral will receive the same high level of commitment and support.

In essence, PlanSmart Solutions is your trusted partner for efficient NDIS plan management. We handle the financial intricacies, so you can focus on achieving your NDIS goals and living life to the fullest. Choose us for a reliable, efficient, and supportive approach to managing your NDIS funds.

Australian Property Prices Continues to Rise

Over the past 30 years, we have observed various cycles of growth and declines across the national index. Each of these upswings and downturns have been influenced by various factors such as taxation policy, monetary policy decisions, economic shocks, fiscal stimulus, and broader economic conditions.

A primary factor behind the increase in property prices is the demand for housing outstripping its supply. If we don’t take appropriate steps to address the housing shortage, the demand for housing will likely continue to rise, putting pressure on property prices to rise even further. To put this in perspective, Australia is predicted to experience above-average population growth. Historical trends show that with a growing population, there is a natural increase in property prices due to higher demand.

Business Support: Starting and running a business comes with numerous challenges. Our team of experienced advisors is here to offer ongoing support and guidance, ensuring you have the resources and knowledge needed to overcome obstacles and achieve your goals.

NDIS Consulting: If your business is in the disability sector, we specialize in Disability consulting services to help you navigate the intricacies of this critical program. Our expertise will enable you to effectively provide essential services to individuals with disabilities.

Process Optimization: We believe that efficiency is the cornerstone of a successful business. Our team will work closely with you to assess your processes and identify areas for improvement, ensuring that your operations are as efficient and cost-effective as possible.

At PlanSmart Solutions, we are committed to your success. With our expertise and dedication, we’ll help you not only navigate the complexities of business ownership but also thrive in your chosen industry. Your journey to a smarter, more prosperous business begins with us. Contact us today to take the first step towards a brighter business future.

'Not good for australia': education costs

rising

faster than most households bills

The price of education has skyrocketed in Australia, as the basic costs to send a child to school, university or kindergarten climb quicker than almost every major household expense monitored by the Australian Bureau of Statistics.

As rapid inflation and interest rate rises add to living costs, analysis of the consumer price index shows education fees have escalated in the past 20 years to fill three of the top 10 fastest-growing expenses among 87 categories tracked by the ABS.

Superannuation: Retirees increasingly forced

to use super savings to pay off mortgage

Retirees are increasingly having to use their superannuation to pay off mortgages as housing costs and home loans expand in size.

The decline in home ownership rates among older Australians is posing a significant threat to the adequacy of Australia’s retirement income system, according to a new report commissioned by the Australian Institute of Superannuation Trustees (AIST).

Independent economist Saul Eslake – who is the author of the report titled, “No place like home: the impact of declining home ownership on retirement” – said the decline in home ownership among younger Australians can also be seen among the 35 to 55 age bracket.

“They will increasingly use their super to pay off their mortgage debt which means they won’t be using their super to fund their retirement incomes and instead will be relying on the pension.”

Most australians are struggling with food,

energy, health and housing costs

Many Australians are facing a long-term cost-of-living crisis.

Thanks to inflation and incremental interest rate rises, more than half are reportedly only just making ends meet – or actually failing to do so.

It’s also getting harder and harder for many of us to pay for essentials like food, bills, rents and mortgages. This level of financial stress is similar to what was reported during the pandemic – with 57 per cent of people struggling in 2020 and 55 per cent in 2021.

So, which groups of Australians are now finding it almost impossible to pay for necessities? And how can we encourage greater financial security?

Business Support: Starting and running a business comes with numerous challenges. Our team of experienced advisors is here to offer ongoing support and guidance, ensuring you have the resources and knowledge needed to overcome obstacles and achieve your goals.

NDIS Consulting: If your business is in the disability sector, we specialize in Disability consulting services to help you navigate the intricacies of this critical program. Our expertise will enable you to effectively provide essential services to individuals with disabilities.

Process Optimization: We believe that efficiency is the cornerstone of a successful business. Our team will work closely with you to assess your processes and identify areas for improvement, ensuring that your operations are as efficient and cost-effective as possible.

At PlanSmart Solutions, we are committed to your success. With our expertise and dedication, we’ll help you not only navigate the complexities of business ownership but also thrive in your chosen industry. Your journey to a smarter, more prosperous business begins with us. Contact us today to take the first step towards a brighter business future.

Horror warning as rent rises tipped to hit

insane highs up until 2026

The grim news continues for the one-in-three Australians who rents a home after new analysis revealed that rents will jump a staggering 10 per cent more this year – the highest level since the GFC – and will continue to rise by extraordinary levels into 2026.

Analysis from investment group Jarden shows how the cost of living crisis will continue to hit the one third of Australians who rent, with rental price growth expected to soar beyond its current 15-year high of 7.8 per cent.

It has examined rental inflation in Australia and found it is already running at 10 per cent higher this year – a figure not seen since the GFC in 2008 – and will jump by 8 per cent in 2025. Rents are expected to continue to rise above 6 per cent into 2026 too.

Business Support: Starting and running a business comes with numerous challenges. Our team of experienced advisors is here to offer ongoing support and guidance, ensuring you have the resources and knowledge needed to overcome obstacles and achieve your goals.

NDIS Consulting: If your business is in the disability sector, we specialize in Disability consulting services to help you navigate the intricacies of this critical program. Our expertise will enable you to effectively provide essential services to individuals with disabilities.

Process Optimization: We believe that efficiency is the cornerstone of a successful business. Our team will work closely with you to assess your processes and identify areas for improvement, ensuring that your operations are as efficient and cost-effective as possible.

At PlanSmart Solutions, we are committed to your success. With our expertise and dedication, we’ll help you not only navigate the complexities of business ownership but also thrive in your chosen industry. Your journey to a smarter, more prosperous business begins with us. Contact us today to take the first step towards a brighter business future.

Saviour Financial Services

Mortgage Saviour

Whether you’re facing financial hardship or simply looking for better mortgage options, Mortgage Saviour offers personalized support to keep you in your home.

Scholarship Saviour

Our mission is to help you create a fund that will eliminate debt and give your child the education they deserve creating a secure financial future for them.

Deposit

Saviour

Designed to help homebuyers save for their property deposits. Whether you're a first-time buyer or looking to upgrade, Deposit Saviour makes saving for your home deposit easier and more achievable.

Home Layby Plan

Offers a convenient solution for homebuyers looking to purchase property through layby plans. Discover how Homelayby Plan can help you achieve your homeownership goals hassle-free.

Rent

Saviour

Whether you need short-term relief or ongoing support, our platform is designed to make renting more affordable and stress-free. Explore how we can help you stay on top of your rent with ease.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

ABOUT US

Welcome to Saviour! What started from humble beginnings, the founder and CEO Vincent Scali has gone on to become a respected member of the industry with his degree in Finance and Mortgage Broking Management Real Estate Practice Agency, you can rest assured that you’re in good hands. We believe that financial freedom is within everyone’s reach. Our mission is to empower individuals and businesses by providing the tools, insights, and strategies to take control of their financial future. Whether you’re managing personal savings, planning for retirement, or navigating the complexities of business finance, we’re here to help you make informed decisions.

With more than 40 years of proven experience in the industry on our belt and a wide network of trusted lenders, we are able to offer a range of financial products and solutions that suit our client’s needs.

Our platform offers a wide range of services, including expert articles, financial calculators, investment strategies, and personalized consultations tailored to your unique needs. No matter where you are on your financial journey, we’re here to guide you every step of the way.

Certifications & Qualifications

Contact Us Today

To Start Your Journey

Accredited and trusted by

more than 40 lenders